Windstorm Insurance

Windstorm Mitigation

Windstorm mitigation involves strengthening your home against wind-related perils and can save you money on your home insurance.

What's Windstorm Mitigation?

Windstorm mitigation involves fortifying your home with special features that help it withstand high winds caused by a hurricane or severe windstorms. These features reduce potential damage on your home.

What Is a Wind Mitigation Inspection?

Simply put, a wind mitigation inspection (also called a windstorm mitigation inspection) is where a certified inspector looks over a property for specific weather withstanding features. These features can be anything from door/window coverings to the way your roof is attached to your home and how your roof is sealed to prevent water from entering. Though wind mitigation is not required to get home insurance, it can result in substantial savings.

Why Does Wind Mitigation Save You Money?

A wind mitigation inspection is the only inspection that can significantly reduce the cost of your insurance policy. That’s because this inspection can affirm whether your home has features that drastically decrease the severity of property loss from hurricane wind. As always, the safer and stronger your home is, the lower your premiums may be.

All the windstorm-withstanding features the inspector looks for may seem like minor details, but they make a world of difference when a windstorm or hurricane strikes. The appropriate wind mitigation features can be the difference between your home weathering the storm and a total rebuild.

That’s why Karl Grace Insurance agents highly recommend investing in wind mitigation features and getting a wind inspection.

How Much Money Can You Save with Wind Mitigation?

That depends on where you reside and what features your home has. Along the coast, savings can range from a few hundred to well over $1,000. Wind mitigation savings are most substantial in Florida where the state requires insurers to offer these discounts.

Keep in mind that the average cost for a wind mitigation inspection is about $100. Though that may seem like an investment, you’ll usually at least break even in the amount it can save you on your coverage (again, this depends on where you live).

How to Maximize Wind Mitigation Savings

After the wind inspection is complete, the inspector will offer suggestions that could improve the sustainability of your property. You can then make changes to your property or simply submit your wind mitigation report to your Karl Grace Insurance agent.

You’ll likely receive the most savings if you take the inspector’s suggestions, which will also add to the value of your home and is never a bad thing! However, we’re happy to crunch the numbers and see how much you can save based on your inspection report alone.

What Wind Mitigation Features Will an Inspector Look For?

These are some of the features the inspector will assess and suggest improvements for:

Roof covering: The inspector will start off with the basics. For the roof, that’s the covering – the material it’s made of. The inspector will also take a look at the age of the roof and condition it’s in. So, if it’s been replaced recently, provide the permit you had for the construction; it’ll help you in the long run.

Roof-deck attachment: This is how the shingles are secured to the roof deck and how the roof deck is secured to the truss/rafters. During this part of the inspection, the inspector will even look at the length of the nails, which can determine the discounts you can receive.

Roof-to-wall connection: This tells the inspector how well your roof is attached to the walls of your property and how it would withstand intense hurricane winds.

Secondary water resistance: The inspector will look to see if you have a protective layer that sits between the primary layer of the roof and the insulating layer of your roof. Think of it as that light rain jacket you wear even though you have an umbrella.

Roof geometry: This is the shape of your roof. The roof shape determines how well your roof may withstand a windstorm.

Opening protection: The inspector will take a look at the windows and doors to see if you have extra protection on them. For instance, they will check for shatterproof windows, bracing on the garage door, hurricane-rated doors, and storm shutters. Our agents always recommend putting up shutters before the inspector arrives to make sure you get that easy credit.

If you do decide to make structural changes to your home, make sure you work with a licensed engineer and contractor.

How to Prove You’ve Had a Wind Mitigation Inspection

Simply provide a copy of your wind mitigation report to your Karl Grace Insurance agent. If you think you’ve had one done, you can look over your current policy and see if you received any sort of windstorm credits. If so, you can ask for a copy of the inspection from your current carrier.

Keep in mind that the wind mitigation inspection has to be current. If it’s older than five years old, it’s time for a new one!Top of Form

More on Windstorm

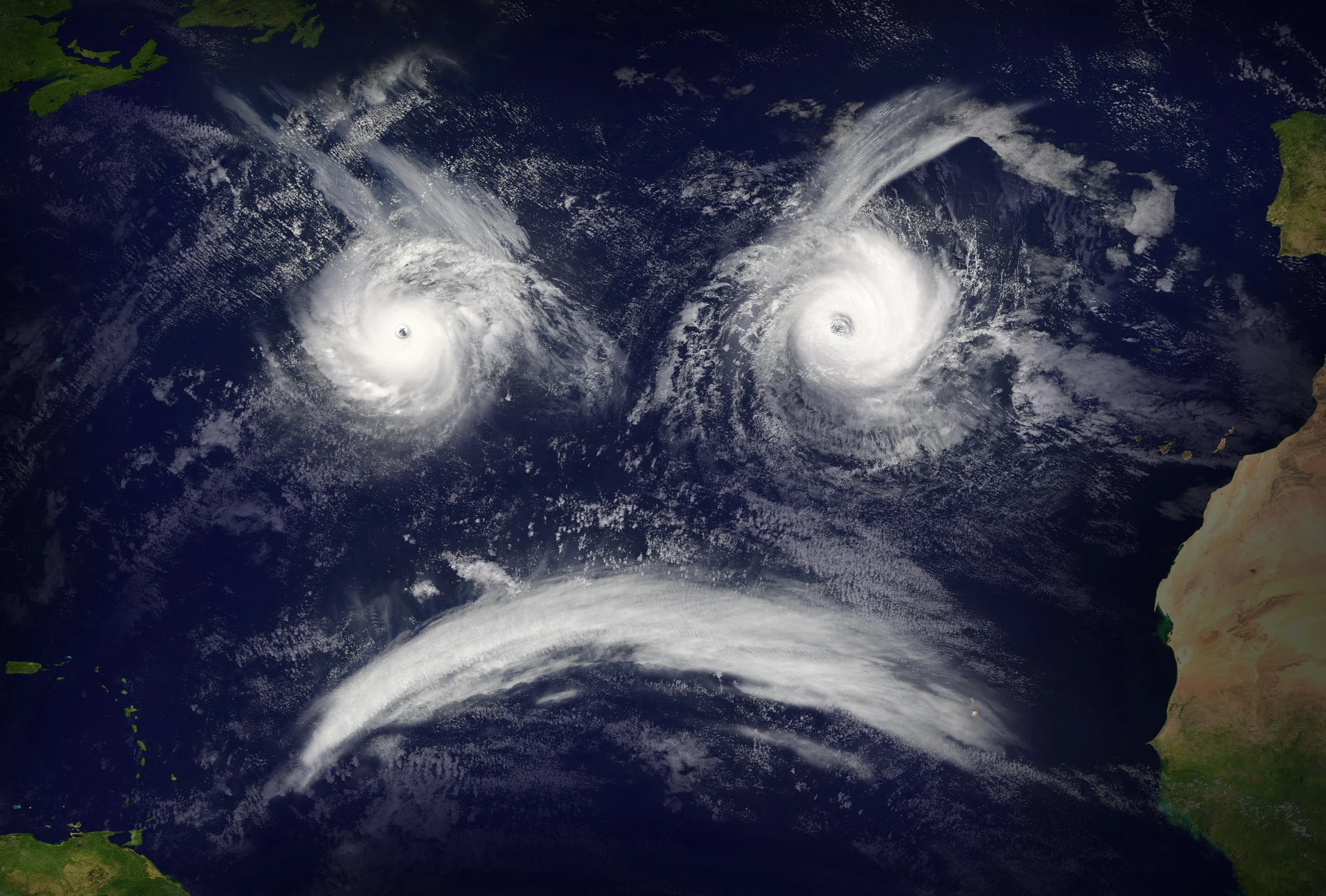

A Stormy Issue

Island paradises and tropical locales are always popular. The water, the beaches, the warm winds are very attractive conditions. However, they are also the originating locales for tropical storms and hurricanes.

The dark side of the tropics is that all of the water and warm temperatures make up the key ingredients for cooking up massive storms. The low pressure areas allow the build-up of violent wind movement that is fuel by warmth and water. The hurricane season is a long parade of storms that form, build in power and size and then move toward land, and property……and people.

Often the major worry is “what is the storm’s category?” A storm’s potential life cycle goes may go from Normal Conditions – Tropical Depression – Tropical Storm – Hurricane (Category 1 up to Category 5).

Naturally it makes sense to be highly concerned about the size of storm surges (water and waves pushed by storms) and wind speeds; but less powerful storms do not automatically mean that there is less danger! Even when a storm does not maintain hurricane status, it can cause tremendous problems as it travels hundreds, even thousands of miles!

A slow-moving tropical storm or low category hurricane may not cause as many problems with wind damage; but may create wide-spread, substantial damage by inundating large areas with torrential rains. Massive amounts of water, smashing through areas where they shouldn’t be, is capable of washing away cars, trucks, boats, homes, businesses, bridges, roads and even lives.

In the aftermath, the incredible challenge is to rebuild and, without proper protection - such as flood insurance - the challenge may become impossible. The wish may be that you never have to deal with flooding caused by huge storms….the hope is that, if you do, you CAN deal with it. Flood insurance can be the key to your recovery!